As mentioned, this technique involves allocating an amount or percentage to activities. Here are some popular techniques to consider: You should ultimately choose a budgeting technique that appeals to the way you like to think about your finances. Bigger-picture thinkers might prefer categorising their expenditure into "needs", "wants" and "savings". Choose a budgeting techniqueĭetail-oriented people might prefer listing down monthly expenditures and allocating a set amount to each activity. 5 tips for quick and effective home budgeting 1.

More importantly, with budget planning, you're less likely to make impulse buys that could pinch your wallet. Either way, setting out clear monthly expenditure and savings goals helps keep you accountable.

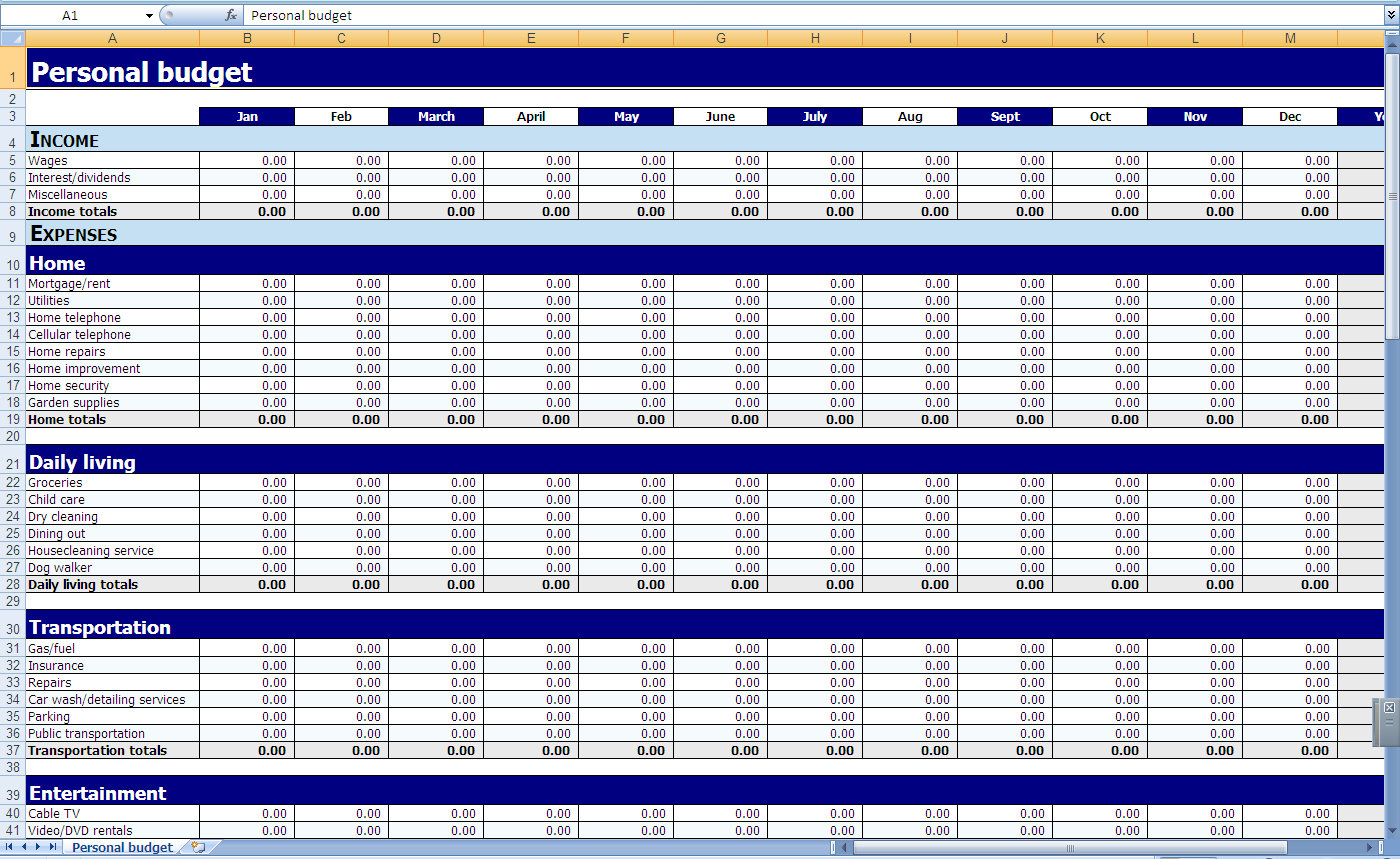

Although many people prefer to manually jot down their monthly household template, you can always opt for a sleeker online budgeting app. Ideally, the best household budget template would outline a plan for you to balance your expenditure with a healthy amount of savings. It involves balancing your cash inflow (income) with cash outflow (bills and expenditure). What's a household budget template and does it actually work?Ī household budget template is essentially a plan that helps you manage your home expenses. They are neither a recommendation nor an eligibility test for any product and should not be construed as financial advice, investment advice or any other sort of advice. Home Budget Worksheet - Our original selection of home budget worksheets.*Whilst every effort has been made to ensure the accuracy of this calculator, the results should only be used as an indication.Personal Budget Spreadsheet The 12-month version of the personal budget version.Personal Monthly Budget - Like the one above, but less detailed, and designed to fit on a single page.Family Budget Planner - This is the 12-month version of the household budget spreadsheet listed above.Money Management Template - Record transactions to automatically populate the budget vs.If you add or remove any categories, just make sure that the formulas used for the totals don't get messed up. If your Net is negative, that means you have overspent your monthly budget.Īdding or Removing categories: The household budget template contains a very detailed list of categories, which you may or may not need. The Monthly Budget Summary table totals up all your income and expenses and calculates the Net as Income minus Expenses.

If you spend more than you budgeted, the Difference between the Projected and Actual values will be negative, and if your Actual income is less than your Projected income, the Difference will be a negative number. In this spreadsheet, the calculations are set up so that negative numbers are bad. The cells in the "Difference" column use conditional formatting to make negative numbers red. At the end of the month, you record in the "Actual" column how much you really spent during the month. This represents your goal - you're trying to keep from spending more than this amount. You record your desired budget for each category in the "Budget" column. The purpose of this worksheet is to help you compare your monthly budget with your actual income and expenses.

Household budget spreadsheet how to#

You may also want to read the article " How to Budget". Our article " How to Make a Budget" explains how to use these spreadsheets to create your budget.

You'll want to replace the values in the Home Expenses category with your own. To use this template, fill in the cells highlighted with a light-blue background (the "Budget" and "Actual" columns). 42 Effective Ways to Save Money Budgeting Tips for the New Year Using the Household Budget Worksheet

0 kommentar(er)

0 kommentar(er)